SPF INVESTMENT PACKS

SPF stands for Special Purpose Vehicle, which is a type of investment vehicle that is designed to pool capital from investors.

If the Subanpaonuado Foundation has issued a bond with an interest rate of 1.2% per week, and the cost per bond is Ghc 500.00, and the duration of the bond is 6 months, then the interest payments that investors will receive will be calculated based on these factors.

To calculate the total interest payment for the duration of the bond, you would multiply the principal amount of the bond (Ghc 500.00) by the interest rate (1.2% per week) and the number of weeks in 6 months (approximately 24 weeks).

For example, the total interest payment for the duration of the bond would be:

500 x 0.012 x 24 = Ghc 144.00

This means that over the course of 6 months, an investor who holds a bond with a principal amount of Ghc 500.00 and an interest rate of 1.2% per week would receive interest payments totaling Ghc 144.00.

It is important to note that the actual interest payments that an investor receives may vary depending on the performance of the underlying assets that the bond is invested in. It is important to carefully monitor the performance of the bond and the underlying assets to ensure that your investment is performing as expected. Moreover, the interest of the bond will start hitting the account of the invest two weeks after the bond date of purchased.

Certainly, let me provide a more detailed explanation of the SPF investment packs launched by the Subanpaonuado Foundation.

1. Purpose and Benefits of the SPF Investment Packs:

- The primary purpose of the SPF investment packs is to help the Subanpaonuado Foundation generate internal revenue to finance its SPF business loan.

- By issuing the SPF investment packs, the foundation is able capital from its members and the general public.

- The proceeds from the sale of the investment packs are used by the foundation to fund its business operations and the SPF business loan.

- In return for their investment, the investors receive regular interest payments and the return of their principal investment at maturity.

- This provides a fixed, guaranteed return for the investors, making it a low-risk investment option.

- The investment packs also help the foundation stabilize its economy and achieve its aims and objectives.

2. How the SPF Investment Packs Work:

- The investors purchase the SPF investment packs, which are essentially a bundle of SPF bonds.

- The proceeds from the sale of the investment packs are used by the Subanpaonuado Foundation to fund its business operations and the SPF business loan.

- The investors receive regular interest payments on their investment, typically semi-annually or annually, depending on the terms of the bond.

- At maturity, the investors receive the return of their principal investment, plus the total interest earned over the life of the bond.

3. Key Features of the SPF Investment Packs:

- Fixed, Guaranteed Return: The investors receive a fixed, guaranteed return on their investment through the interest payments provided by the SPF bond.

- Low-Risk Investment: The Subanpaonuado Foundation is the issuer of the bond, making it a low-risk, secure investment option for the investors.

- Diversification: The investment packs allow investors to diversify their investment portfolio by adding the SPF bond to their existing investments.

- Liquidity: The investors can redeem their investment at maturity, providing them with liquidity and the opportunity to reinvest in other investment opportunities.

In summary, the Subanpaonuado Foundation has launched the SPF investment packs as a way to generate internal revenue, provide investment opportunities for its members, and achieve its organizational goals. The investment packs involve the purchase of SPF bonds, which offer a low-risk, fixed-return investment option for the investors.

Dear Subanpaonuado Foundation Members,

I am thrilled to announce that the bond issuance we launched on the 16th of September, 2024, has been a resounding success! We are proud to inform you that all 21 bonds have been sold, with Mr. Joseph Nkrumah being the majority bondholder, followed by Nana Okyere Samuel, Mr. Francis Sackey, and Mrs. Irene Anku.

Congratulations to everyone who participated in this successful bond issuance. Your support has enabled us to raise funds that will be used to support our programs and initiatives, ensuring that we continue to make a difference in the lives of those we serve.

Additionally, I would like to inform you that today marks the end of the issuance of the SPF business loan application form. We encourage you to take advantage of this opportunity if you need financial assistance for your business ventures.

Furthermore, I am pleased to inform you that every bond purchased attracts a 1.2% weekly interest, starting from 22nd, October, 2024 and ending on the 22nd of March, 2025. This means that your investment will grow over time, providing you with a secure and stable return.

Thank you for your continued support and commitment to the Subanpaonuado Foundation. We look forward to keeping you updated on our progress and the impact we are making in our community.

A) To calculate the weekly, monthly, and semi-annual returns for each investor, we can use the given interest rates: Weekly ( 1.2% ), Monthly ( 4.8% ), and semi-annual ( 28.8% )

1. Mr. Joseph Nkrumah:

Weekly return: Ghc 6,000.00 × 1.2% = Ghc 72.00

Monthly return: Ghc 6,000.00 × 4.8% = Ghc 288.00

- Semi-annual return: Ghc 6,000.00 × 28.8% = Ghc 1,728.00

2. Nana Okyere Samuel:

Weekly return: Ghc 2,000.00 × 1.2% = Ghc 24.00

Monthly return: Ghc 2,000.00 × 4.8% = Ghc 96.00

- Semi-annual return: Ghc 2,000.00 × 28.8% = Ghc 576.00

3. Mr. Francis Sackey:

Weekly return: Ghc 1,500.00 × 1.2% = Ghc 18.00

Monthly return: Ghc 1,500.00 × 4.8% = Ghc 72.00

- Semi-annual return: Ghc 1,500.00 × 28.8% = Ghc 432.00

4. Mrs. Irene Anku:

Weekly return: Ghc 1,000.00 × 1.2% = Ghc 12.00

- Monthly return: Ghc 1,000.00 × 4.8% = Ghc 48.00

- Semi-annual return: Ghc 1,000.00 × 28.8% = Ghc 288.00

Weekly disbursment amount

- Mr. Joseph Nkrumah - ( 6,000.00 ÷ 24 ) = ( Ghc 250.00 + Ghc 72.00 ) = Ghc 322.00

Nana Okyere Samuel - ( 2,000.00 ÷ 24 ) = ( 83.33 + 24.00 ) = Ghc 107.33

- Mr. Francis Sackey - ( 1,500.00 ÷ 24 ) = ( 62.50 + 18.00 ) = Ghc 80.50

- Mrs. Irene Anku - ( 1,000.00 ÷ 24 ) = ( 41.66 + 12.00 ) = Ghc 53.66

Summary

1. Mr. Joseph Nkrumah Boahene will receive Ghc 322.00 every week starting from 22nd October 2024.

2. Nana Okyere Samuel will receive Ghc 107.33 every week starting from 22nd October 2024

3. Mr. Francis Sackey will receive Ghc 80.50 every week starting from 22nd October 2024

4. Mrs. Irene Anku will receive 53.66 every week starting from 22nd October 2024.

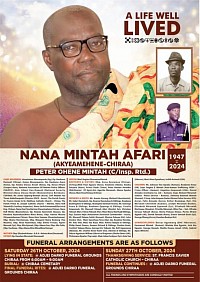

Funeral Arrangement of the Late Peter Ohene Mintah.

Funneral Arrangement:

* Date of funeral: October 26, 2024

* Time of funeral: 9:00 AM

* Location of funeral: Chira A Cemetery

* Final rites: Adjel Darko

* Thank you note: St. Fer

* Contact information: Cat ccrc Chira A

* Additional notes: Funer cont II Adjel Darko Funer A Ds Chira A symen in Dully.

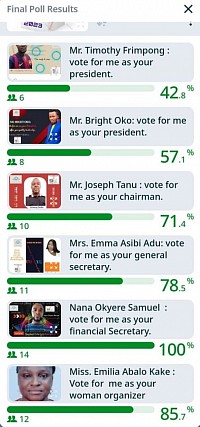

The SPF executives election conducted by the electoral committee of the Subsnpaonuado Foundation has just ended at 4: 00 pm today, 22nd December 2024. The following are the candidates who contested for the positions below:

1. Mr. Frimpong Timothy for Presidential - 42.89%.

2. Mr. Oko Bright for Presidential - 57.11%.

3. Mr. Joseph Tanu for chairmanship - 71.4%.

4. Mrs. Emma Asibi Adu for General Secretary - 78.5%.

5. Nana Okyere Samuel for Financial Secretary - 100%

6. Miss. Emilia Abalo Kake for Women Organizer - 85.7% .

However, apart from the presidential position that was contested by two candidates, the other candidates went to the polls unopposed. The chairman of the SPF electoral committee decleared Mr. Bright Oko as the president - elect for the Subanpaonuado FOUNDATION.